Even today, hospital operations without IT are hardly conceivable, as hacker attacks unfortunately often demonstrate.

However, digital innovations such as AI-supported diagnostic software and clinical decision support systems promise to fundamentally improve patient care in hospitals in the near future.

In reality, such solutions often encounter a significant problem: the limited ability to monetize software innovations in the stationary sector.

The so-called NUB procedure gives hospitals the opportunity to finance innovative methods for a limited period of time. NUB stands for “new examination and treatment methods” and refers to a procedure that allows clinics to temporarily reimburse innovative procedures until they are permanently included in the DRG system (more information on the DRG system can be found below).

This article is aimed at (future) manufacturers of software solutions for the stationary sector. The central question we answer is: Is the NUB procedure a suitable way to monetize your software solution?

We provide you with an overview of the system that manages cost reimbursement in hospitals and offer advice on the best way to monetize your software product.

Table of Contents

- 1. Cost reimbursement in the inpatient sector

- 2. What are NUBs?

- 3. Financing software solutions as a NUB: Is that possible?

- 4. Conclusion

- 5. Outlook: Alternative financing options for digital innovations

1. Cost reimbursement in the inpatient sector

First of all, we would like to give you a brief introduction to the financing system for inpatient care so that the NUB procedure becomes clearer to you. For the sake of clarity, we will not go into detail and will deliberately simplify certain issues.

In general, hospitals in Germany are financed in two ways:

- Investment costs (e.g., new buildings, modernization, equipment): These are borne by the federal states. The states also decide on the construction, expansion, and closure of clinics and must therefore ensure comprehensive care coverage.

- Operating costs (treatment costs for patients): These are covered by health insurance companies. Operating costs are financed through flat rates per case and a care budget. Remuneration is based on the DRG system, which stands for Diagnosis Related Groups.

This article focuses on operating costs, as NUB payments are used to supplement the DRG system in precisely this area.

1.1 Brief Overview of DRG Flat rates

The DRG system (“Diagnosis Related Groups”) is the central remuneration system for inpatient hospital services (in the somatic area).

Each treatment is assigned a flat rate (DRG) that reflects the typical cost of diagnosis, severity, and services provided. Based on this assignment and billing, the hospital then receives a fixed amount of money for each treatment.

The complete list of DRGs and associated flat rates can be viewed in an online catalog.

Key elements of the system are:

- Assessment ratios: Each DRG is assigned a cost weight that reflects the average resource utilization.

- State base rate: This is negotiated annually between hospital associations and health insurance companies at the state level and multiplied by the valuation ratio to determine the actual price of treatment (in simplified terms).

- Care budget: Since 2020, nursing staff costs have been separated from the DRGs and are reimbursed via a separate budget.

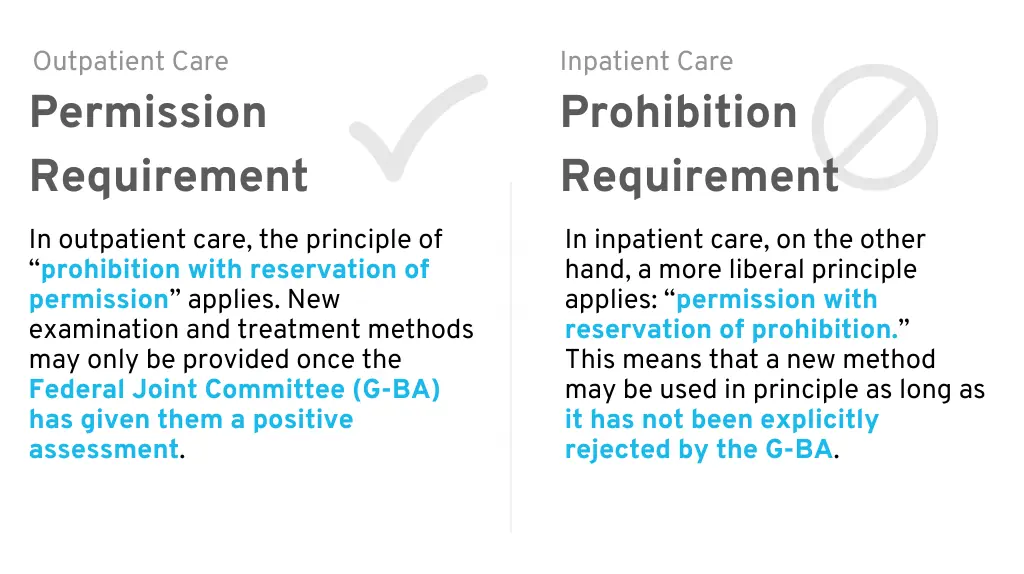

1.2 Permission with Prohibition Requirement

In the German hospital sector, the principle of “permission with reservation

This means that new methods may be used as long as the Federal Joint Committee (G-BA) has not expressly excluded the method.

This differs from the “reservation of approval” that applies in the outpatient healthcare sector, where a new method may only be used once the G-BA has explicitly given its approval.

In Germany, the use of new methods in inpatient care is therefore permitted initially. However, this does not automatically mean that a hospital will actually introduce your innovative product.

Permission Requirement (outpatient) vs. Prohibition Requirement (inpatient)

Financing in the DRG system is the real hurdle: your new product will probably not be financially covered as part of an existing DRG.

Therefore, you usually have no choice but to convince each clinic individually that your software solution offers cost savings or revenue growth potential for the facility and medical benefits for patients. The clinic must then finance the product costs from its existing budget and hope that this investment will ultimately pay off.

In practice, this leads to a so-called “innovation gap”: clinics are allowed to use new methods, but often cannot bill for them in a way that covers their costs. This is where so-called NUBs come into play:

2. What are NUBs?

NUB stands for “new examination and treatment methods.” This refers to methods that cannot yet be adequately reimbursed with flat rates and additional fees in the DRG system. The legislature has created a procedure that enables individual hospitals to receive temporary reimbursements for these NUBs (“NUB fees”).

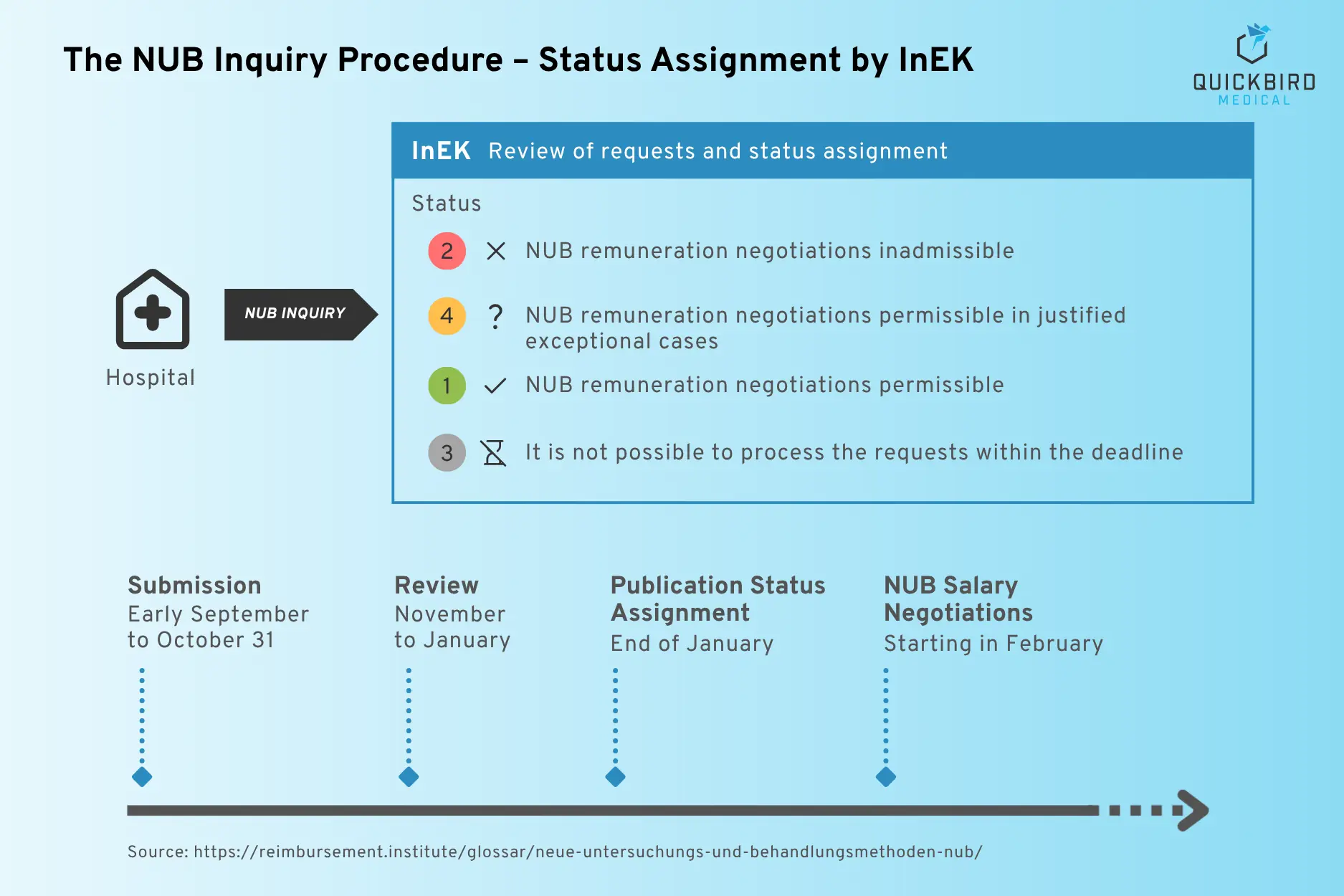

If a hospital wishes to use such a new method, it submits an annual application to the Institute for the Hospital Remuneration System (InEK). If the method is evaluated positively, hospital-specific remuneration can be negotiated until it is regularly included in the DRG catalog.

NUB could play a role for digital solutions or software products if they are part of a new method. This would be the case, for example, if your digital tool enables an innovative treatment concept or a novel examination method.

The NUB procedure and status assignment

(Source: Reimbursement Institute)

What makes this special is that NUB funding is not provided on a nationwide basis, but exclusively for the hospital that submitted the application. In addition, the fees are initially only valid for one year.

After the deadline has expired, it may be possible to firmly establish the NUB in the DRG system.

So much for the theory: but does a NUB application for a software-based method also work in practice?

3. Financing software solutions as a NUB: Is that possible?

QuickBird Medical has been working closely with pharmaceutical expert Dr. Arndt Schmitz to address the following question: Could NUBs be a relevant route to reimbursement for software product manufacturers?

Dr. Arndt Schmitz has more than 20 years of experience in pharmaceutical research and development. He has led projects in clinical development, biomarker validation, and digital health solutions, and most recently served as Medical Software Product Lead. He first encountered the topic of NUB while pursuing his MBA in Health Care Administration. Today, he continues to be active in the digital health sector.

NUB as a Reimbursement Option

Unfortunately, the results of our research and discussions to date paint a sobering picture with regard to NUB financing for software products. The path seems difficult, if not impossible, to navigate, and in general it is unlikely to be suitable for most software products.

This is for the following reasons:

3.1 Reason 1: Software as an Investment Good rather than an Operating Good

In the inpatient context, as outlined above, the legislator distinguishes between reimbursement of operating costs and investment costs.

Operating costs include consumables such as medications or bandages, which are used once and then discarded. These costs are covered by the DRG system and, for innovations that are not yet included in the DRG system, indirectly by the NUB procedure if necessary.

Investment costs include, for example, the purchase of a device, the cost of which is incurred once and must be amortized over many years. This could be heating equipment, but also an operating table. Investment costs are not covered by the DRG system, but must be financed by the federal states.

This means that the costs of your software product will not be reimbursed under the NUB procedure either. Unfortunately, the costs of software products must normally be treated as investment expenses for accounting and tax purposes. The exact definition of investment costs can be found in Section 2 of the Hospital Financing Act.

3.2 Reason 2: Are Software Products not welcome at NUB?

Now, one might naively assume that it is possible to avoid classification as capital goods by adapting the business model of one’s own software product. Instead of high initial acquisition costs (investment), one switches to a pay-per-use model so that the costs tend to be more like operating costs. This could easily be achieved using dongles or software-based DRM (digital rights management) approaches.

Apart from the fact that this argument is questionable in terms of investment vs. operating costs, this approach does not work for other reasons as well. Unfortunately, software products are not a priority in an already underfunded stationary system. Therefore, according to our research, even software products that are calculated per case based on system architecture would be rejected in the NUB application.

The cost of the software product competes with costs such as those for drug-based therapies. The money invested in software operating costs is then lacking in other areas. Based on discussions with experts in this field, this seems to be the prevailing situation and mentality.

3.3 Reason 3: The “U” in NUB should be lowercase

When it comes to new examination and treatment methods (NUB), examination methods play a much smaller role. The majority of approved NUB applications relate to drug-based treatment methods. There are many reasons for this.

However, software (e.g., for AI-based cancer detection in radiology) is mostly used in the field of examination methods. Examination methods, regardless of whether they are standalone software or hardware products, receive only a fraction of the funding through the NUB procedure. Dr. Arndt Schmitz sums it up as follows: The “U” in NUB should actually be written in lower case.

3.4 Reason 4: Empirical Data supports these Theories

The QuickBird Medical team analyzed a publicly available database from the Reimbursement Institute (an institution of RI Innovation GmbH) containing previous NUB applications. From thousands of applications, we identified the few that were software-related. Although we have no information about the completeness and accuracy of this data, it does shed light on the situation.

The result:

- Total number of NUB software applications: Of the total 2,445 applications (since 2014), we were only able to identify 11 NUB applications for dedicated software products. The few software-related applications identified focus exclusively on imaging and 3D processes.

- Negatively evaluated NUB software applications: Of the 11 software-related applications identified, all were rejected. They were evaluated by InEK with status 2 or 4. More information on the categorization of numbers can be found here.

- Positively evaluated NUB software applications: According to this, there was not a single positively evaluated software-related application among 2,445 applications. If you are reading this article and know of a relevant application that we have overlooked, please feel free to contact us.

This analysis supports the initial assessment that software products have little chance of being reimbursed under a NUB. There appears to be no case that has ever been assessed positively. It can therefore be assumed that future NUB applications for apps or other software will also be rejected.

4. Conclusion

This analysis by QuickBird Medical and Dr. Arndt Schmitz clearly shows that the NUB procedure is not a promising way to obtain temporary or permanent reimbursement for software products under the DRG system. To our knowledge, there has been no documented case of successful NUB reimbursement for standalone software to date (please send us an email if you know of any such cases). The structural hurdles suggest that this is unlikely to change in the foreseeable future.

Even if this result seems sobering, it is still valuable for manufacturers of software solutions: those who know early on that the NUB path is effectively closed for pure software products can take this into account in their business model and market access planning and avoid bad investments. In addition, the term “NUB” will inevitably come up in discussions with experts at some point. So it’s definitely a good idea to be prepared and informed.

The hospital sector nevertheless remains a relevant market. Software products can also be successfully introduced in clinics without NUB. However, this is then covered by the institutions’ investment budget. Convincing arguments are key here: cost reductions, efficiency gains, revenue potential for certain service areas, and medical benefits for patients. If the added value for everyone can be clearly demonstrated, hospitals may be willing to invest in digital solutions even without reimbursement regulations.

The aim of this article was to provide you with an overview of the conceivable instrument “NUB” and to classify it in a simplified manner (in keeping with the nature of a blog article). We would like to take this opportunity to once again thank Dr. Arndt Schmitz for his excellent cooperation in researching and writing this technical article.

If you are looking for other ways to monetize your software, the following chapter provides an overview of important reimbursement channels for software products in the German healthcare system.

5. Outlook: Alternative financing options for digital innovations

In addition to the NUB procedure, there are also several other ways in which software manufacturers can obtain reimbursement under the German healthcare system.

These include, among others:

- Overview of all paths to reimbursement: Read our white paper

- Digital Health Applications – DiGA Procedure: Our guide

- Selective contracts with health insurance companies: Our guide

- Central Prevention Review Board (ZPP): About our guidelines

- Digital Care Applications – DiPA Procedure: Our guide

- Financing through the Innovation Fund: Our guide